Almost all the contemporary banking trends need tremendous amounts of data to succeed. The right analytics on timely, comprehensive data supports industry-specific use cases – such as customer 360s, recommendation engines, micro-segmentation of customers, fraud detection, and more – to increase revenues, make smarter decisions, and improve operational efficiency. These use cases are regularly enhanced by machine learning technologies that involve huge amounts of data.

Furthermore, the tremendous desire for data, as well as its effectiveness in fulfilling the above business drivers and other functions in this industry, has contributed to the rise of fintech companies. They are born in the cloud, typically have no physical presence (which reduces capital costs) and are extremely data-savvy. Their business model is rooted in data, enabling them to automate several processes that typically require manual approaches. Not surprisingly, fintech organizations are transforming the financial services industry as a whole, spurring even traditional entities to keep pace with their innovations, swift processing times, and high customer satisfaction rates. As a result, conventional financiers have been increasingly migrating their data and applications to the cloud to match the agility of fintech upstarts. The demand for mass data quantities and the ability to share and utilize them have never been more crucial to determining the winners and losers in this industry.

Roadblock Ahead: Data Security and Privacy Regulations

The biggest challenge for this industry is granting secure access to large quantities of data, with sensitive data like PII being a significant portion of it, to satisfy the demands of business users and data scientists, while also adhering to security and regulatory requirements. The conundrum is clear: as your data volumes grow, so must your guardrails for it, too. Many organizations respond to this challenge by deliberately limiting data access to end-users due to a lack of holistic data visibility and proper data governance compounded by inadequacies in related areas like data discovery, cataloging, and tagging sensitive data. Without a centralized governance platform, business units are severely limited in their access to the data they need to meet the business drivers for financial services. This limitation undermines the value of any investments in modern cloud and data technologies.

The Privacera Approach: Data Governance, Access Control, and Data Security in One

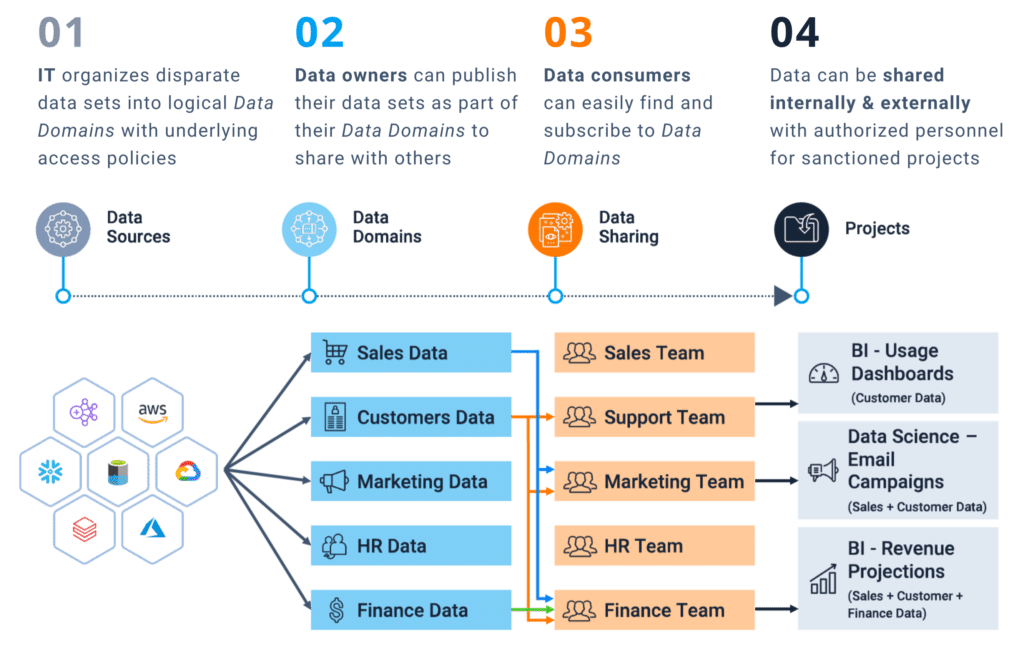

The solution to granting secure access to the universe of available data while upholding guardrails for regulatory compliance and sensitive data is to employ a unified data access governance/data privacy platform tailored for hybrid and multi-cloud deployments. With the recent release of PrivaceraCloud 4.0, Privacera introduces a new data sharing approach called Governed Data Sharing that delivers a new level of flexibility and power to accelerate analytical initiatives. This modern offering inherently supports the distributed data access governance model in which data stewards familiar with use cases in respective business domains grant end-user access by enforcing centralized policies at the local level in individual sources. This way, uniform policy enforcement occurs regardless of where users or data are, as delegated by stewards or data domain owners who know the data best.

Framework for Governed Data Sharing

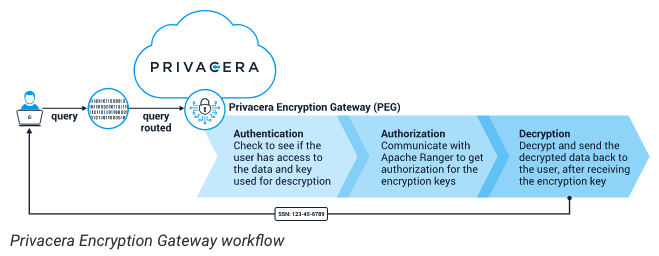

Privacera’s access governance technology provides several controls that meet the dual data access mandate prevalent in finance. The first is to automate the data discovery process to identify sensitive elements in datasets. This step becomes the basis for obfuscating this information to increase user access to the data necessary to meet this industry’s business drivers. Next are obfuscation mechanisms such as masking, encryption, and tokenization to ensure the right users access sensitive data without viewing any PII-related attributes. Masking sensitive data elements at the columnar level, for example, suffices to ensure data scientists and engineers can access all the data they request for constructing a machine learning model. This method directly addresses the data quantity issue via secure access that complies with data privacy mandates. It produces desired effects like increasing the accuracy of machine learning models by enabling data scientists’ access to the full array of features in an organization’s data.

Case Study: Collaborative FinTech Platform Fulfills Rigorous Financial, Privacy, and Legal Regulations

An international financial services firm developed a platform for collaboration between fintech and traditional players. Exchanging inter-party information requires rapidly sharing, aggregating, and anonymizing sensitive data between organizations to gain the trust of users and adhere to the numerous financial regulations and legal requirements they must fulfill. The greatest challenge was that the company had to enforce—and demonstrate—compliance with other companies’ environments across hybrid and multi-cloud. Conventional governance approaches were too slow and couldn’t provide data security at scale, impeding organizational agility and info security measures.

Privacera’s unified data access governance technology rectified these problems with unparalleled visibility, audit-ability, data lineage, and reporting of who was accessing what data when—across source systems—to meet internal policies, comply with regulations, and satisfactorily demonstrate so to regulators. Its obfuscation approaches implemented policies for controlled user access, building inter-organizational trust for customers of the international financier’s data exchange platform while empowering them with automated data discovery, tagging, and obfuscation of sensitive data.

Closing Remarks

The financial services industry can make good on the numerous business drivers requiring access to ever greater amounts of data while still maintaining adherence to a growing number of regulations. To learn more on how Privacera helps our financial services customers ensure these benefits while mitigating regulatory and data privacy risks, please read our latest white paper.

Learn more about Privacera here, or contact us to schedule a call to discuss how we can help your organization meet its dual mandate of balancing data democratization with security to maximize business insights while ensuring privacy and compliance.