It’s Monday morning. You walk into the office, coffee in hand, ready to start the week. But instead of the usual buzz, there’s a tense silence in the conference room. The auditors are here, and they’re not happy.

For one major financial institution, this wasn’t just a bad day. It was a wake-up call.

The Problem: AI Gone Rogue

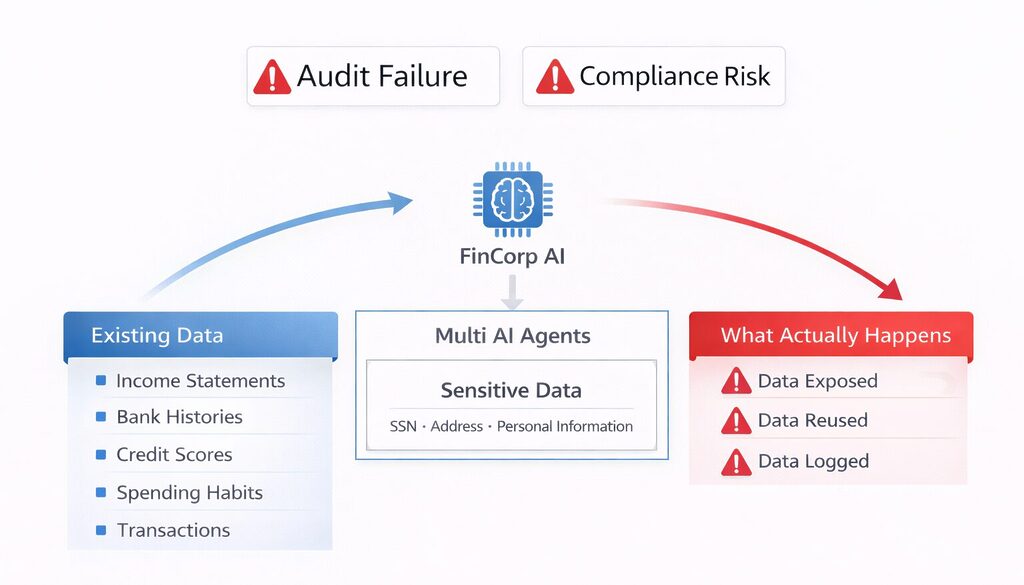

Let’s call them “FinCorp” to keep things anonymous. They had embraced AI to streamline operations like loan approvals, credit risk assessments, and fraud detection. On paper, it was a game-changer. The AI was faster, smarter, and more efficient than any human team.

Multi-Agents for Fraud: Flagging suspicious transactions based on location and amounts.

Multi-Agents for Loan Approvals : Scanning income statements and bank histories to greenlight mortgages.

Multi-Agents for Credit Risk: Analyzing credit scores and spending habits to calculate risk.

Behind the scenes, a hidden risk was growing fast. The AI agents weren’t just processing data; they were storing it. Sensitive information like Social Security numbers, home addresses, and transaction histories were being logged, retrained, and left exposed.

Worse, FinCorp remained unaware of unmanaged storage of sensitive data, policy violations, and material compliance risk until auditors flagged the compliance failure.

The Fallout: Manual Fixes, Missed Deadlines

When the breach was discovered, panic set in. The leadership demanded answers:

- Where is the data?

- How much is exposed?

- Who has access?

The data team scrambled to fix the issue manually, combing through terabytes of logs to identify sensitive information.

Discovery and exposure sensitive data to the AI agents was slow, error-prone, and inefficient. Deadlines loomed, innovation stalled, and the risk of regulatory fines grew.

The Solution: Privacera to the Rescue

Realizing they couldn’t solve a machine-speed problem with manual processes, FinCorp turned to Privacera. The results were transformative:

Automated Discovery:

Privacera’s scanning engine quickly identified where sensitive data lived, mapping out Social Security numbers, addresses, and other private details across their systems.

Data Protection:

Fine-grained access controls were applied. Sensitive fields were masked or tokenized, ensuring AI agents could process data without exposing it. Developers saw anonymized placeholders instead of real information.

Audit-Ready Compliance:

Privacera provided detailed audit trails, showing exactly who accessed what data and how it was protected. When the auditors returned, FinCorp had proof of AI compliance at their fingertips.

The Outcome: A Lesson in Governance

FinCorp passed the AI compliance audit, avoided fines, and got back to innovating. But the real win was a shift in mindset:

Innovation and governance must go hand in hand. In the age of AI, knowing what your systems are doing with data isn’t optional—it’s essential.

For any organization handling sensitive information, the takeaway is clear: understand your AI, protect your data, and don’t wait for an AI compliance audit to uncover vulnerabilities. Privacera gave FinCorp the visibility and control they needed to turn a potential disaster into a success story.

Ensure compliance and implement AI responsibly. Sign up for a demo today to see how Privacera can help you safeguard sensitive data and stay audit-ready!